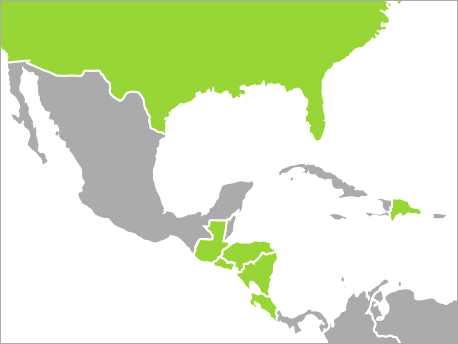

With the announcement that the U.S.-Columbia Free Trade Agreement will be implemented beginning May 15, it is an appropriate time to review the market changes for the U.S.-Central American-Dominican Republic Free Trade Agreement countries which have similar market issues. The agreement is between the U.S. and El Salvador, Guatemala, Honduras, Nicaragua, Costa Rica and the Dominican Republic as separate countries.

The six countries of CAFTA-DR have 48 million people, are closer geographically to the U.S. than most other trading partners and have roughly the same amount of trade with the U.S. as Australia. The agreements were signed in August 2004 and mostly came into force, except for Costa Rica, in 2006 and early 2007. The Costa Rican agreement took effect on January 1, 2009. As a single market, CAFTA-DR is the seventh largest U.S. agricultural market after South Korea.

Half of U.S. exports became duty free immediately, including high-quality cuts of beef, cotton, wheat, soybeans, some fruits and vegetables, processed food products and wine. Other products received improved access through tariff rate quotas, but over-quota tariffs are phased out over 15-20 years. These include beef, pork, dry beans, vegetable oil, poultry, rice, corn and dairy products.

Using calendar year 2005 as the base year, the dollar value of agricultural exports from the U.S. increased from $1.96 billion to $4.47 billion, a 128 percent increase. Coarse grains, mostly corn, were the highest value product both years growing 185 percent from $340 million in 2005 to $970 million in 2011. Wheat was number two increasing from $260 million to $610 million, a 135 percent increase, while soybean meal was number three at $210 million and $420 million, a 100 percent increase. Rice rounded out the big four at $170 million in 2005 and $180 in 2012, a 6 percent increase. Grain prices have more than doubled since 2005, so the volume increases are lower. Coarse grain volumes were almost unchanged at 3.2 million metric tons (MMT); wheat up from 1.5 MMT to 1.8 MMT, a 20 percent increase; soybean meal up from 910,000 MT to 1.0 MMT, a 10 percent increase; and rice down from 760,000 MT to 490,000 MT, a 36 percent decline.

Substantial changes have occurred in the smaller volume and value products. Soybean oil exports increased 93 percent in volume to 137,000 MT, while increasing almost 400 percent in value. Red meat increased 244 percent in volume to 55,000 MT and 366 percent in value. Dairy products increased 68 percent in volume to 42,000 MT, and 122 percent in value, and poultry meat volume increased 97 percent to 136,000 MT and 143 percent in value. Other products were also active: processed fruits and vegetables more than doubled, snack food were up 80 percent, breakfast cereals 70 percent and fresh fruits 60 percent.

The six countries already had preferential import access to U.S. markets under the Caribbean Basin Initiative (CBI) and Most Favored Nation (MFN) preferences for developing countries. Almost all agricultural items were entering tariff free. The value of imports increased from $3.1 billion in 2005 to $5.7 billion in 2011, an 84 percent increase. Bananas and plantains were the largest import items in 2005 on a dollar basis at $650 million followed by unroasted coffee at $600 million. Those roles were reversed in 2011 with unroasted coffee at number one at $1.49 billion and bananas and plantains at $1.21 billion, together at 47 percent of imports in 2011 with volumes up about 10 percent. Other fresh fruit was $420 million in 2005 and $1.4 billion in 2011 and up about 28 percent in volume. Raw and processed sugar and sweeteners imports were $340 million in 2005 and $530 million in 2011.

The U.S. is also gaining on sanitary and phyto-sanitary issues that are equal in importance with tariff reductions. The CAFTA-DR countries are moving toward recognizing the U.S. meat inspection system as equivalent to their own which will simply exporting meat. As noted earlier, red meat volume was up 244 percent and poultry meat was up 97 percent. Countries that emphasize tourism are growing markets for U.S. meat. Further integration of agriculture among the countries will be helpful on issues like pest control in fruits and vegetables and livestock diseases.

The Obama Administration has also used the labor policy provisions of CAFTA. In August of last year, U.S. Trade Representative Ron Kirk in a letter to the Guatemalan Minister of Economy requested an arbitration panel “with respect to the effective enforcement of Guatemalan labor laws related to the right of association, the right to organize and bargain collectively, and acceptable conditions of work.” The U.S. had earlier asked for consultations on the issues which did not resolve them. The establishment of an arbitration panel was required upon request of the U.S. The case is ongoing.

The U.S. continues to face increased competition in these markets as CAFTA-DR countries sign FTAs with other countries such as the EU. An advantage in these markets is that the U.S. was first with an FTA rather than catching-up with other countries. Increased trade among the six CAFTA-DR countries has also occurred.

The greatest growth has occurred in the further processed and consumer-oriented products as would be expected. The U.S. was the primary supplier of the basic commodities where lack of sufficient domestic production has long driven increased trade. Some of the largest tariff reductions are in processed and consumer products and more tariff reductions and increased tariff rate quotas will occur in the immediate years ahead. The Foreign Agricultural Service notes that they continue to work to improve the transparency and predictability of TRQ administration in the region and reduce delays in approving some registrations and certificates.

The long-term growth for these markets will ultimately be determined by economic growth and a larger middle class. Economic growth in 2011 ranged from 4.5 percent in the Dominican Republic to 2.0 percent in El Salvador. The World Bank’s Cost of Doing Business index for 183 countries found the six CAFTA countries ranked from Guatemala at 97 to Honduras at 128in the ease of doing business. Regardless of the rate of market growth, CAFTA-DR gives U.S. agricultural suppliers a competitive position in these markets.

Ross Korves is an Economic Policy Analyst with Truth About Trade & Technology